How To Prepare Your Payment

• Make your check or money order payable to “United States Treasury.” Don’t send cash. If you want to pay in cash, in person, see Pay by cash, later.

• Make sure your name and address appear on your check or money order.

• Enter your daytime phone number and your SSN on your check or money order. If you have an Individual Taxpayer Identification Number (ITIN), enter it wherever your SSN is requested. If you are filing a joint return, enter the SSN shown

first on your return. Also, enter “2023 Form 1040,” “2023 Form 1040-SR,” or “2023 Form 1040-NR,” whichever is appropriate.

• To help us process your payment, enter the amount on the right side of your check like this: $ XXX.XX. Don’t use dashes or lines (for example, don’t enter “$ XXX—” or “$ XXX xx/100”)

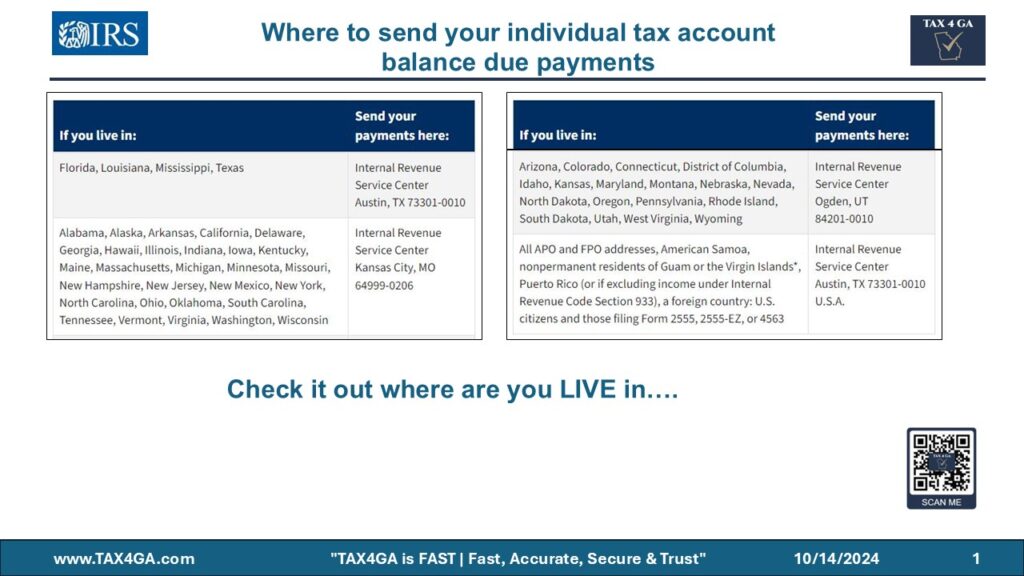

체크에 받는 사람은 반드시 “United States Treasury”로 기록하셔야하며 SSN을 꼭 기입하고 살고있는 주소의 해당 관할 IRS Office로 보내셔야 됩니다.”