Employment TAx

If you have employee, you are responsible for several federal, state and local taxes.

What is 941, 944, 943 and 940 Tax?

When you have employees, you as the employer have certain employment tax responsibilities that you must pay and forms you must file.

Federal income tax withholding

Employers generally must withhold federal income tax from employees' wages. To figure out how much tax to withhold, use the employee's Form W-4, Employee’s Withholding Certificate, the appropriate method and the appropriate withholding table described in Publication 15-T, Federal Income Tax Withholding Methods.

Social security and medicare taxes

An employer generally must withhold social security and Medicare taxes from employees' wages and pay the employer share of these taxes. Social security and Medicare taxes have different rates and only the social security tax has a wage base limit. The wage base limit is the maximum wage subject to the tax for the year. Determine the amount of withholding for social security and Medicare taxes by multiplying each payment by the employee tax rate. For the current year social security wage base limit and social security and Medicare tax rates refer to Publication 15, (Circular E), Employer's Tax Guide.

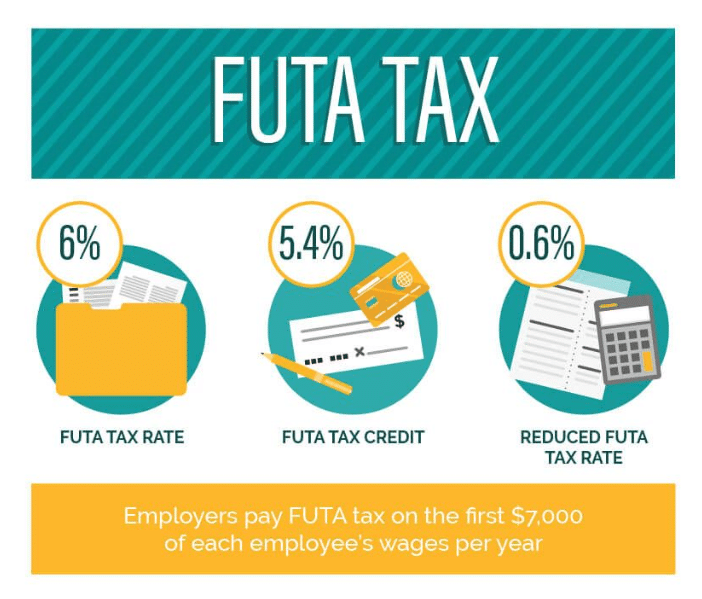

Federal unemployment(futa)taxs

Employer’s report and pay FUTA tax separately from Federal Income tax, and social security and Medicare taxes. You pay FUTA tax only from your own funds. Employees do not pay this tax or have it withheld from their pay. Refer to Publication 15 and Publication 15-A, Employer's Supplemental Tax Guide for more information on FUTA tax.

- Federal income tax withholding

- Social security and Medicare taxes

- Federal unemployment (FUTA) tax

941, 944, 930, 940 Tax는 고용관련 세금을 의미합니다. 다시말하면 고용을 하지 않는 다면, 고용과 관련된 세금을 납부하지 않아도 된다는 의미이지요. 회사를 설립하고 종업원을 고용하면 종업원에 대한 급여를 지급하여야 겠지요. 종업원에게 급여를 지급한다면 이에 대한 세금을 납부하여야 하며 이와 관련되어 납부의무가 있는 세금을 고용관련 세금이라 정의하며 관련된 내용은 세법으로 규정하고 있습니다.

종업원을 고용하고 급여를 발행할 경우에 941 Form을 이용하여 원천징수한 소득세와 사회보장세 등을 보고하여야 합니다.

Form 943은 농업관련 비지니스를 하는 경우 보고하는 양식입니다. 943으로 보고하는 양식은 941 이나 944로 보고해도 문제없습니다.