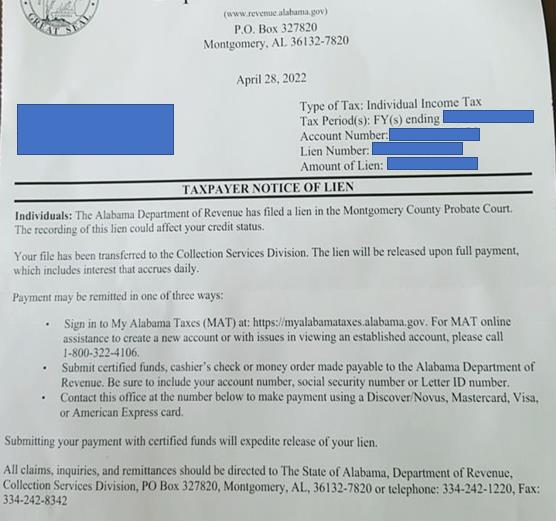

TAx Lien | 세금체납 담보설정

A tax lien is a lien imposed by law upon a property to secure the payment of taxes.

우리말로 해석하면 체납액에 대한 담보를 설정한다는 의미지요.

통상적으로 납부세액에 대해서 체납했을 경우에 취해지는 조치입니다.

On-Line 납부

Send a Cashier’s Check or Money Order to DOR.

Contact officer to make payment by Credit card

Last solution is Claim. If you do not know why the tax lien letter send by DOR. Then you should call to the DOR Collection Service Division. The Office, CSD is going to explain the reason of lien to you.

Letter of Lien

What Is a Tax Lien? A tax lien is a legal claim against the assets of an individual or business that fails to pay taxes owed to the government. In general, a lien serves to guarantee payment of a debt such as a loan, or in this case, taxes. If the obligation is not satisfied, the creditor may proceed to seize the assets.