Federal Tax Lien. Here’s a summary of the key points:

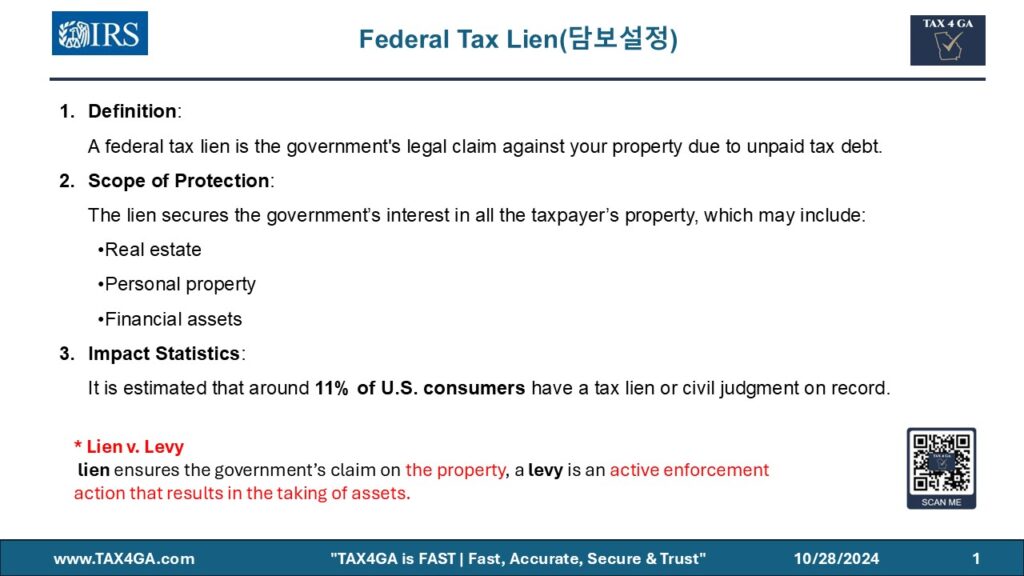

Definition:

A federal tax lien is the government’s legal claim against your property due to unpaid tax debt.Scope of Protection:

The lien secures the government’s interest in all the taxpayer’s property, which may include:- Real estate

- Personal property

- Financial assets

Impact Statistics:

It is estimated that around 11% of U.S. consumers have a tax lien or civil judgment on record.

통상적으로 세금이 체납되면 납부하라는 통보서가 발송되며, 이후에 답변이 없거나 납부하지 않으면 Lien이 통보되며 처리됩니다.

해결방법은 1. 전부 체납된 세금 납부, 2. 분할납부, 3. 조정(OIC), 4. CSED 10년 종료, 5. 미국을 떠나는 방법, 6. Bankruptcy 의 방법이 있습니다.

가장 좋은 선택은 현재의 상태를 진단 후 대책을 강구해서 처리하는 방법입니다.

해결방법은 1. 전부 체납된 세금 납부, 2. 분할납부, 3. 조정(OIC), 4. CSED 10년 종료, 5. 미국을 떠나는 방법, 6. Bankruptcy 의 방법이 있습니다.

가장 좋은 선택은 현재의 상태를 진단 후 대책을 강구해서 처리하는 방법입니다.