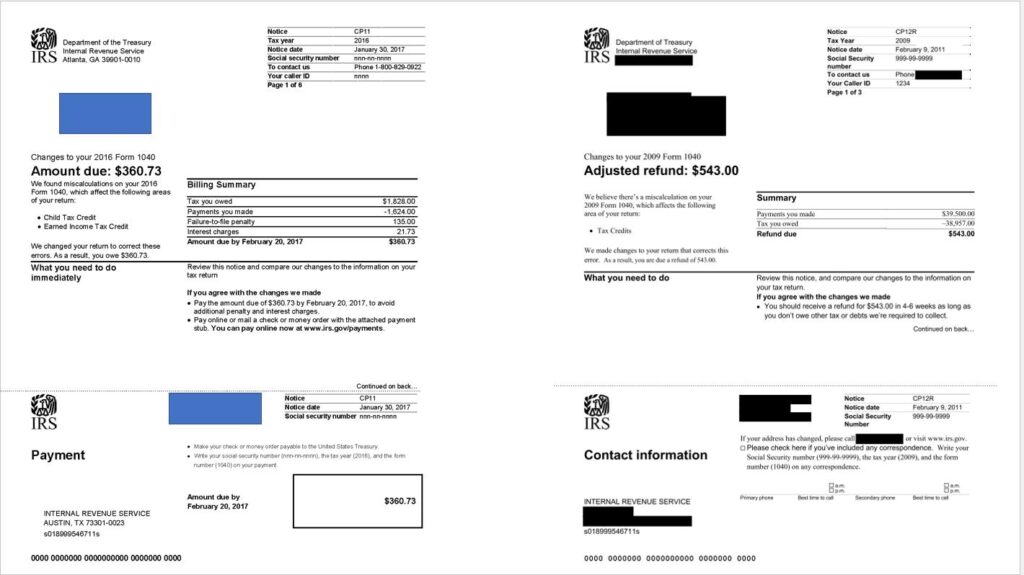

CP 11 Notice from IRS. or What does IRS CP11 mean?

The IRS has adjusted your tax return because of an error, which resulted in a balance due.

Why you received IRS Notice CP11

- When processing your return, the IRS discovered an error.

- The IRS corrected the error and made an adjustment to your return.

- This adjustment resulted in a balance due.

Notice deadline: 60 days

If you miss the deadline: If you do not dispute the changes on a CP11 within 60 days, you must pay the balance due before the IRS will consider reversing the change.

CP11 Notice Letter을 받으신 경우 대부분은 세금보고 계산이 잘못된 부분에 대해서 IRS에서 수정해서 보내는 편지입니다. 관련 내용을 읽어보시고 잘못 보고된 부분에 대해서 납부하시거나 Claim하시면 됩니다.

최근 EIP(경제적 재난지원금)을 받으신 후에 Recovery Rebate Credit 신청을 적게하시거나 많이 한 경우에 IRS에서 CP11 Letter를 통해서 오류를 수정하고 있습니다.

최근 EIP(경제적 재난지원금)을 받으신 후에 Recovery Rebate Credit 신청을 적게하시거나 많이 한 경우에 IRS에서 CP11 Letter를 통해서 오류를 수정하고 있습니다.